after tax income calculator iowa

This results in roughly 35339 of your earnings being taxed in total although depending on. If you make 55000 a year living in the region of Iowa USA you will be taxed 11691.

What To Do When The Irs Is After You Irs Personal Finance Lessons Earn More Money

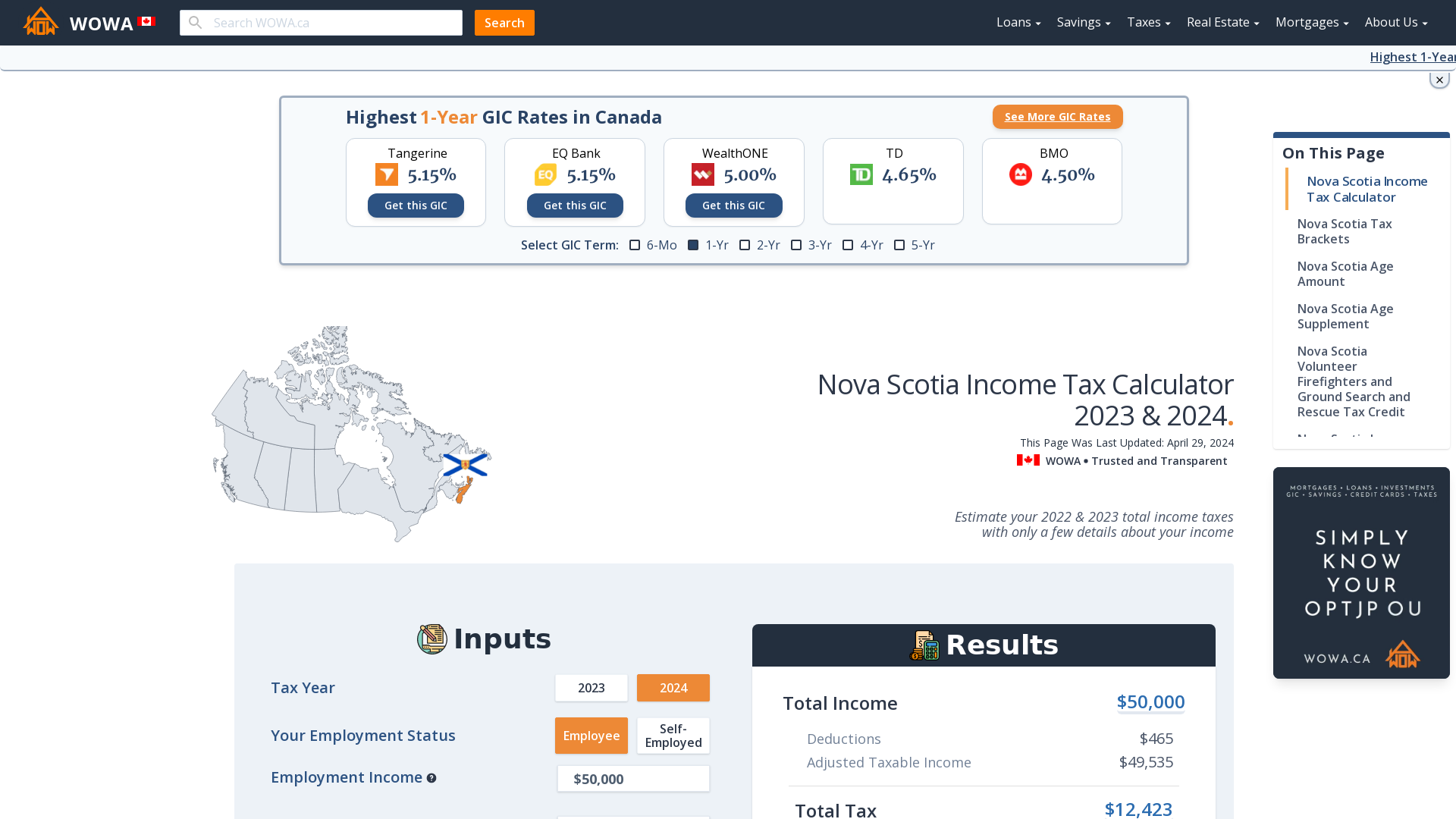

Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs.

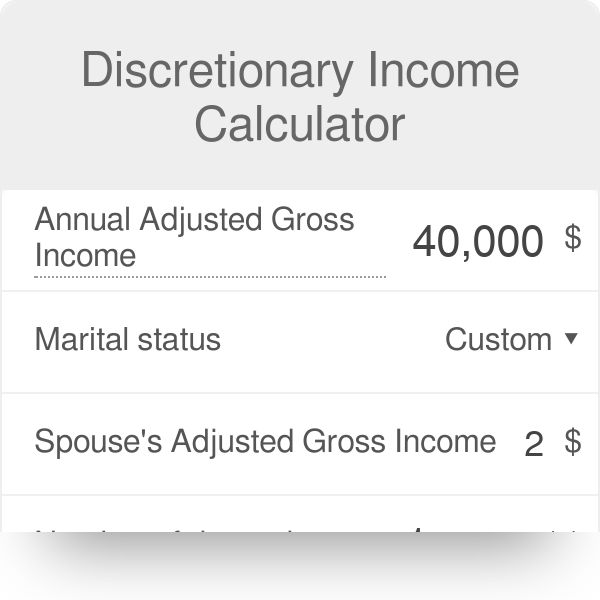

. Our income tax and paycheck calculator can help you understand your take home pay. Iowa collects a state income tax at a maximum marginal tax rate of spread across tax brackets. The Iowa Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Iowa State Income Tax Rates and Thresholds in 2022.

This marginal tax rate means that your immediate additional income will be taxed at this rate. Iowa tax law stipulates that your Federal taxes may be deducted from your gross income for purposes of computing the State income tax. Calculate your Iowa net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Iowa paycheck calculator.

If you make 87000 in Iowa what will your salary after tax be. The Iowa bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. Your average tax rate is 169 and your marginal tax rate is 297.

Switch to Iowa hourly calculator. Iowa Paycheck Calculator - SmartAsset. Iowa tax law stipulates that your Federal taxes may be deducted from your gross income for purposes of computing the State income tax.

4810000 - 424050 4385950 So. Iowas maximum marginal income tax rate is the 1st highest in the United States ranking directly below Iowas. So S - F Adjusted Taxable income for Iowa where F Full Federal Tax calculation and S State taxable income for Iowa.

- Iowa State Tax. Details of the personal income tax rates used in the 2022 Iowa State Calculator are published below the calculator this includes historical tax years which are. For instance an increase of 100 in your salary will be taxed 2965 hence your net pay will only increase by 7035.

After determining their Iowa state tax liability many Iowa taxpayers must pay a school district surtax. Your average tax rate is 213 and your marginal tax rate is 349. You can learn more about how the.

So S - F Adjusted Taxable income for Iowa where F Full Federal Tax calculation and S State taxable income for Iowa. Filing 12000000 of earnings will result in 918000 being taxed for FICA purposes. Enter your info to see your take home pay.

If you make 104000 in Iowa what will your salary after tax be. In this tax example. In this tax example.

The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks. Your average tax rate is 222 and your marginal tax rate is 361. Unlike the Federal Income Tax Iowas state income tax does not provide couples filing jointly with expanded income tax brackets.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. This marginal tax rate means that your immediate additional income will be taxed at this rate. SmartAssets Iowa paycheck calculator shows your hourly and salary income after federal state and local taxes.

That means that your net pay will be 43309 per year or 3609 per month. Our income tax and paycheck calculator can help you understand your take home pay. Filing 12000000 of earnings will result in 635049 of your earnings being taxed as state tax calculation based on 2021 Iowa State Tax Tables.

For instance an increase of 100 in your salary will be taxed 3613 hence your net pay will only increase by 6387. 5310000 - 486800 4823200 So. So for example if your Iowa tax liability is 1000 and your school district surtax is 15 you would pay an additional 150.

This marginal tax rate means that your immediate additional income will be taxed at this rate. This is equal to a percentage of Iowa taxes paid with rates ranging from 0 to 20.

Goodwill Clothing Donation Form Template Donation Form Goodwill Donations Templates Printable Free

Capital Gains Tax Calculator Real Estate 1031 Exchange Capital Gains Tax Capital Gain What Is Capital

How To Calculate Self Employment Tax In The U S Child Support Child Support Quotes Birth Photography

Smartasset S Iowa Paycheck Calculator Shows Your Hourly And Salary Income After Federal State And Local T Retirement Calculator Best Savings Account Financial

Income Tax Calculator Estimate Your Refund In Seconds For Free

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

How Much Should I Set Aside For Taxes 1099

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Iowa Paycheck Calculator Smartasset

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Keep Precise Records Of Rental Income And Rental Expenses For Your Rental Income Business With This Print Business Tax Being A Landlord Business Tax Deductions

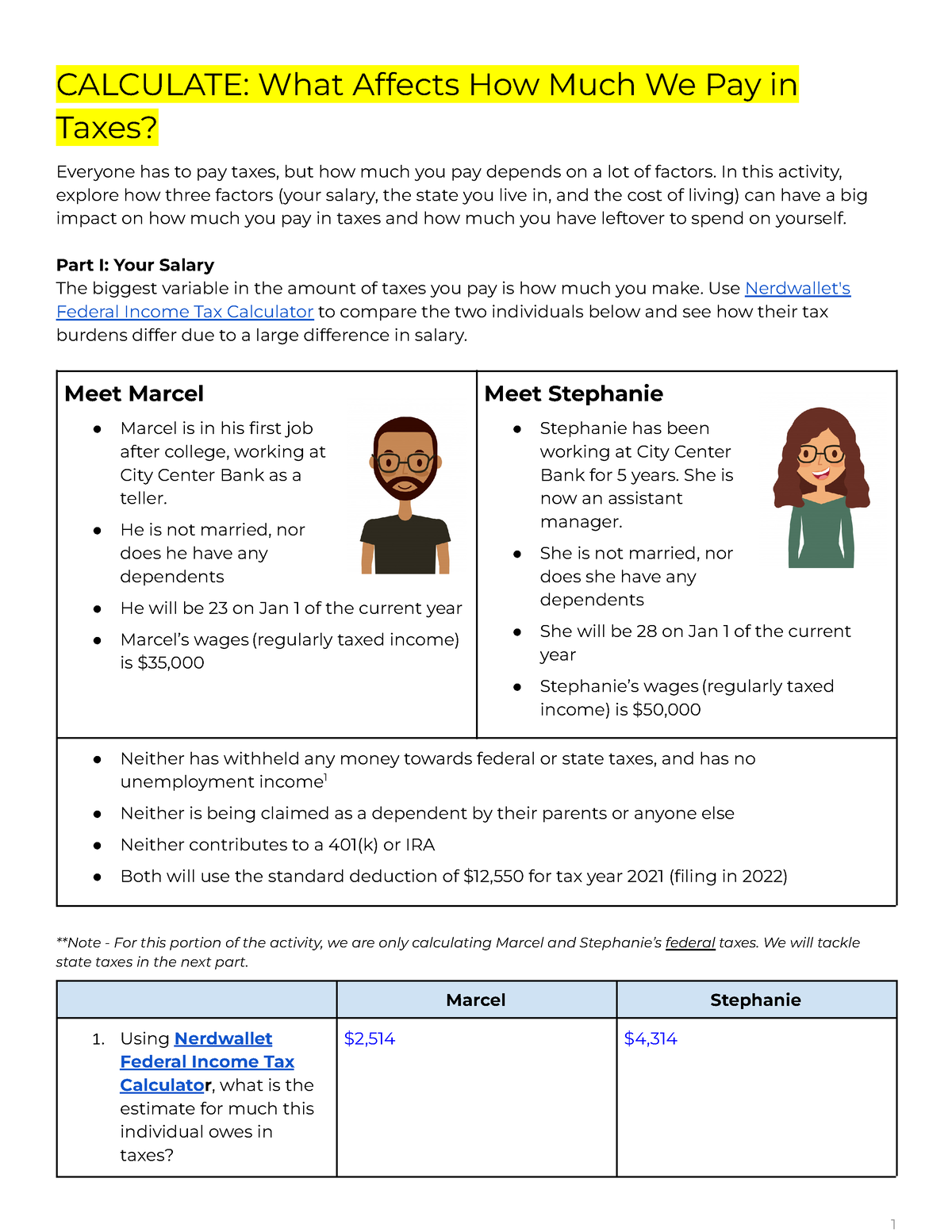

Copy Of Calculate What Affects How Much We Pay In Taxes Calculate What Affects How Much We Pay In Studocu

Salary Paycheck Calculator Calculate Net Income Adp

Finances And Military Benefits Finance Education Financial Counseling Finance